Bank Climate Risk Management II

Moorad Choudhry

35 years: Banking and Capital Markets

In this video, Moorad explores the impact of climate change on banks' risk management strategies. He discovers the regulatory drivers behind climate risk management, and learns about the crucial areas that should shape a bank's climate change risk policy review. From operational shifts due to climate impacts to regulatory compliance and sustainable lending practices, we unpack the essentials for navigating this evolving landscape.

In this video, Moorad explores the impact of climate change on banks' risk management strategies. He discovers the regulatory drivers behind climate risk management, and learns about the crucial areas that should shape a bank's climate change risk policy review. From operational shifts due to climate impacts to regulatory compliance and sustainable lending practices, we unpack the essentials for navigating this evolving landscape.

Bank Climate Risk Management II

9 mins 45 secs

Key learning objectives:

Understand the expected impact of climate change on banks

Outline what is driving climate risk management regulations

Understand the critical areas that should inform the review of a bank’s climate change risk policy

Overview:

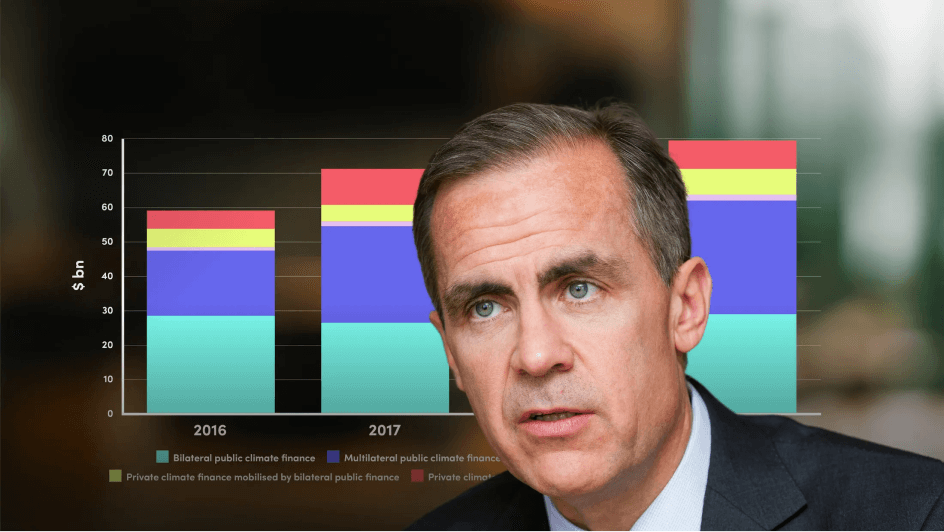

Climate change significantly impacts banks' risk management frameworks, specifically their balance-sheet processes and the credit quality of corporate and SME customers. A study by McKinsey revealed that 15% of a sample portfolio from 46 European banks showed increased risk due to climate change. Regulatory bodies like the UK Prudential Regulatory Authority have mandated firms to manage climate change risks, leading to changes in governance, risk management, and stress testing scenarios. Banks have generally progressed in integrating climate change risks in their policies and governance frameworks, but understanding long-term balance sheet impacts requires more effort. Hence, a comprehensive risk management framework encompassing robust governance structures, risk management strategies, and a focus on scenario analysis is essential.

- Acknowledging the bank's environmental responsibilities beyond legal and regulatory requirements, including impact management through lending activities.

- Clearly defining roles and responsibilities from the Board to employees at all levels in adherence to regulatory rules and ESG matters.

- Minimising the bank's carbon footprint by reducing environmental impact and improving environmental performance across various operational areas.

- Developing products that encourage positive ESG and sustainability activities and establishing an ESG risk appetite that is reflected in lending policies.

Moorad Choudhry

There are no available Videos from "Moorad Choudhry"