Climate Risk Tools

David Carlin

Head of Climate Risk

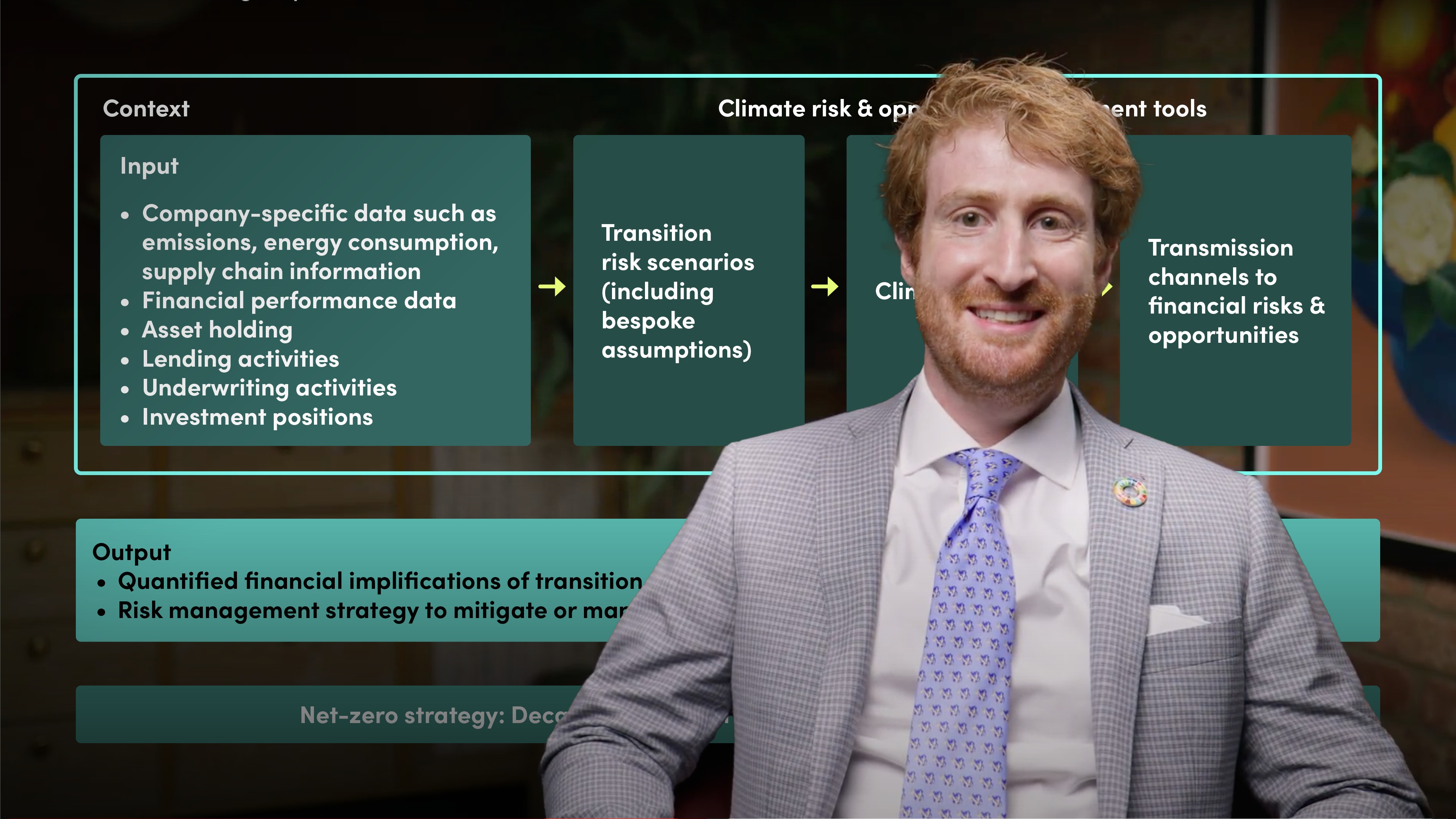

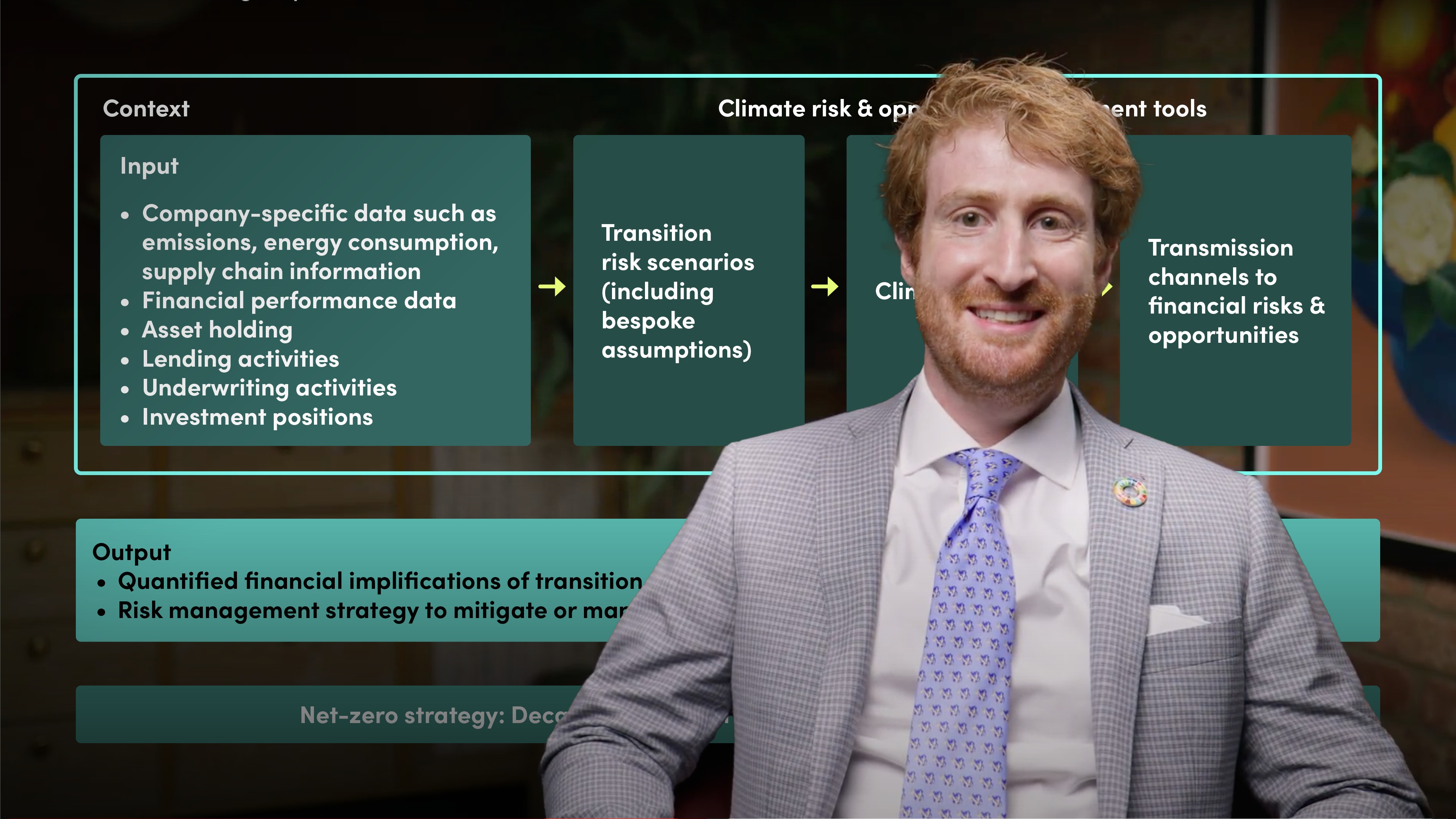

In the previous video David Carlin explored some processes behind transition and physical risk assessments. In the final video of his series , David Carlin explores how financial institutions are using climate risk tools for risk assessment, strategy setting, client engagement, regulatory requirements and assessing opportunities.

In the previous video David Carlin explored some processes behind transition and physical risk assessments. In the final video of his series , David Carlin explores how financial institutions are using climate risk tools for risk assessment, strategy setting, client engagement, regulatory requirements and assessing opportunities.

Climate Risk Tools

4 mins 50 secs

Key learning objectives:

Outline the 5 main use cases of climate risk tools for financial institutions

Understand how financial institutions can pick the right climate risk assessment tools

Overview:

As we move towards a net zero world, there are growing expectations of financial insitutons to make the right decisions regarding climate risk assessment. Hence, they first need to ensure that they choose the right tools to help them with this. They need to consider their main use cases and then select the one most appropriate for their needs depending on the level of analysis they require.

What are the 5 main use cases for financial institutions regarding climate risk tools?

How can financial institutions pick the right tools for climate risk assessment?

David Carlin

There are no available Videos from "David Carlin"