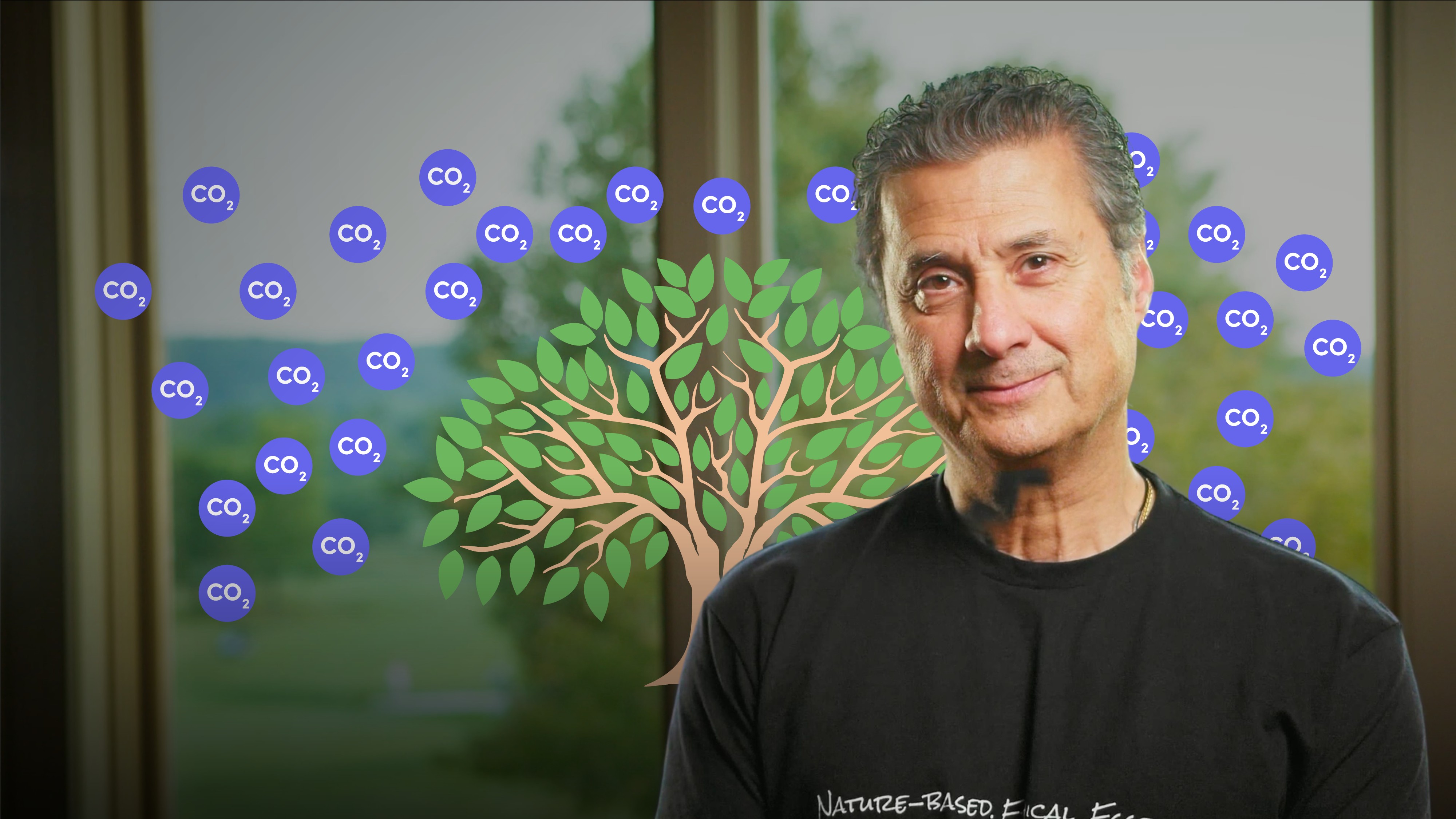

Designing Nature Markets I

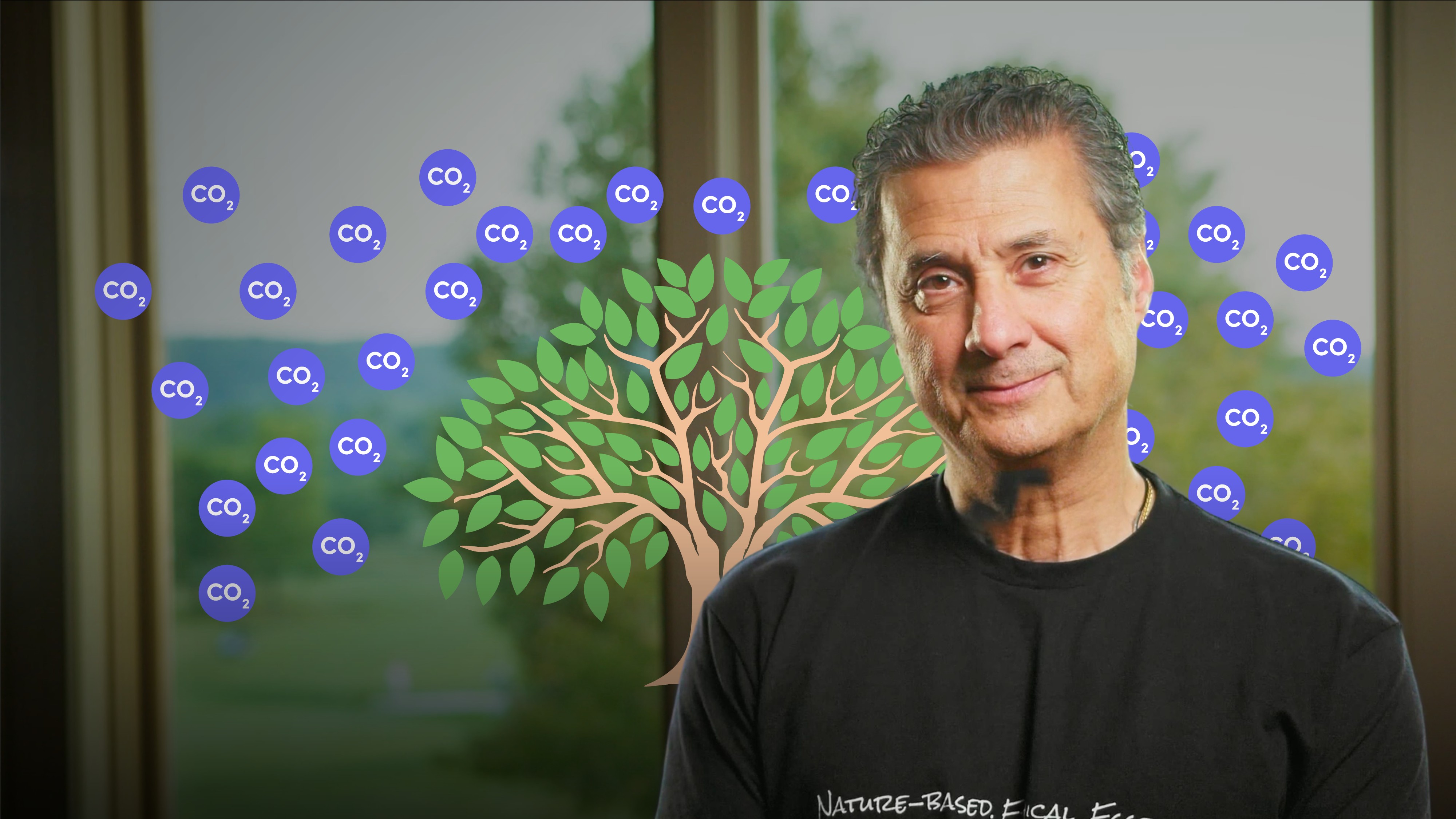

Ralph Chami

CEO & Co-founder: Blue Green Future

In this video, Ralph Chami discusses the prerequisites for successful nature markets and the potential challenges. Ralph also discusses the risks and potential negative outcomes of nature markets. Finally he outlines what the future holds for nature markets.

In this video, Ralph Chami discusses the prerequisites for successful nature markets and the potential challenges. Ralph also discusses the risks and potential negative outcomes of nature markets. Finally he outlines what the future holds for nature markets.

Designing Nature Markets I

13 mins 58 secs

Key learning objectives:

Understand what is required for the effective design of nature markets

Outline the challenges, risks and potential negative outcomes of nature markets

Understand the future of nature markets and how they will develop

Overview:

To effectively design nature markets several key conditions must be met: natural asset owners should sell environmental services and invest in conservation; local and indigenous communities must be primary labor sources; and focus should be on existing markets like carbon trading. Careful market design requires avoiding negative outcomes, ethical revenue management, robust governance, and honouring indigenous roles. Despite challenges like potential exploitation and market monopolisation, nature markets promise to align economic incentives with conservation, fostering equity, sustainability, and climate resilience. The Taskforce on Nature Markets advocates for a framework valuing nature as an asset, essential for a sustainable economy.

For nature markets to function effectively, it's essential that natural asset owners commit to selling environmental services, with a significant portion of revenues earmarked for conservation and restoration efforts. Labour should predominantly come from local and indigenous communities, ensuring that those with generational ties to the land play a central role in stewardship while benefiting economically. A successful launch strategy would build upon existing ecosystem service markets, particularly carbon trading, to capitalise on established mechanisms and investor interest. The foundation of such markets must also include transparent governance structures that prevent corruption and mismanagement, establishing investor and public confidence in the market's integrity and purpose.

Ralph Chami

There are no available Videos from "Ralph Chami"