Introduction to ESG ETFs I

Rahul Bhushan

15 years: Structured Products and Sustainability

In this video, Rahul discusses the rise of ESG ETFs, which have amassed $378 billion in assets by February 2022, aligning investments with strong ESG values. He differentiates ESG investing from impact investing and anticipates future regulations like the EU's Sustainable Finance Disclosure Regulation to enhance transparency and credibility in the ESG ETF market.

In this video, Rahul discusses the rise of ESG ETFs, which have amassed $378 billion in assets by February 2022, aligning investments with strong ESG values. He differentiates ESG investing from impact investing and anticipates future regulations like the EU's Sustainable Finance Disclosure Regulation to enhance transparency and credibility in the ESG ETF market.

Introduction to ESG ETFs I

17 mins 53 secs

Key learning objectives:

Outline the emergence of socially responsible investing (SRI) and ESG

Understand why ESG has been adopted by investment managers

Understand why ESG ETFs emerged

Outline the size, types and outlook of the ESG ETF market

Understand the different types of ESG investing and how it differs to impact investing

Outline how future regulation will continue to evolve

Overview:

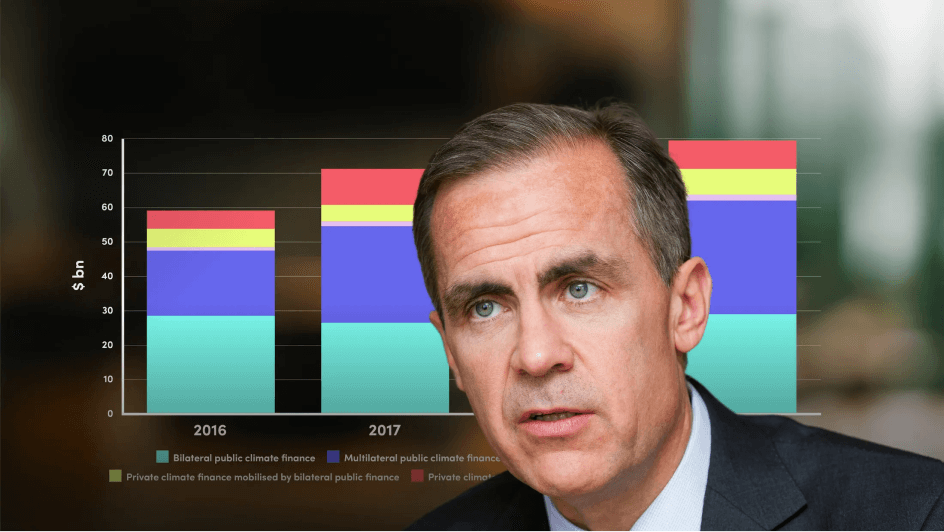

The growth of ESG ETFs is deeply rooted in the history of Socially Responsible Investing (SRI). Originating in the mid-20th century, SRI was a response to ethical concerns, leading investors to omit sectors like tobacco based on moral stances and was heavily shaped by faith-based investing. As time progressed, SRI broadened to include environmental, social, and governance (ESG) factors. Due to this, ESG ETFs emerged, mirroring broad market indices but focusing on companies with strong ESG adherence. The surging demand for ESG has seen a diversification of strategies, from integration and divestment to engagement and impact investing. By 2022, ESG ETF assets reached $378 billion. Due to the exponential growth in sustainable investments, regulatory measures, like Europe's Sustainable Finance Disclosure Regulation, have been introduced to combat potential greenwashing, aiming for a transparent and standardised ESG landscape.

Rahul Bhushan

There are no available Videos from "Rahul Bhushan"