Introduction to IFRS S1 and S2

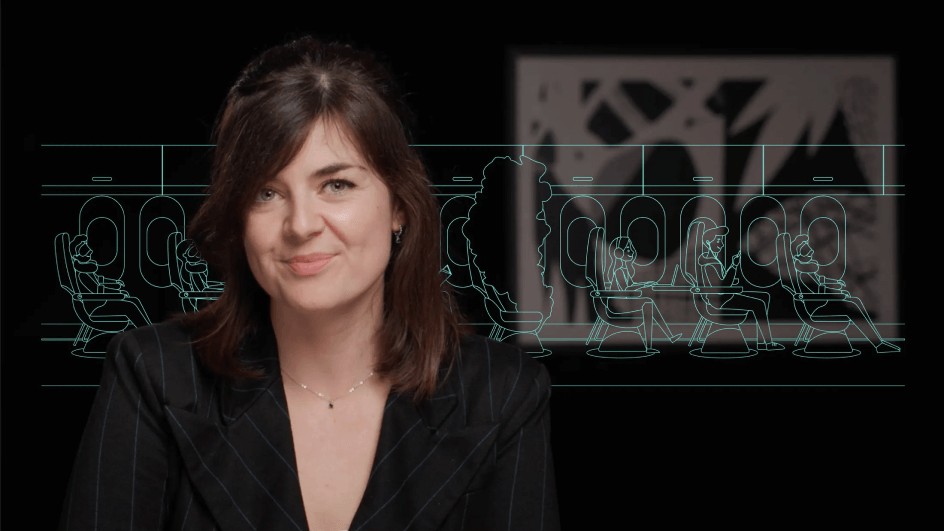

Michelle Horsfield

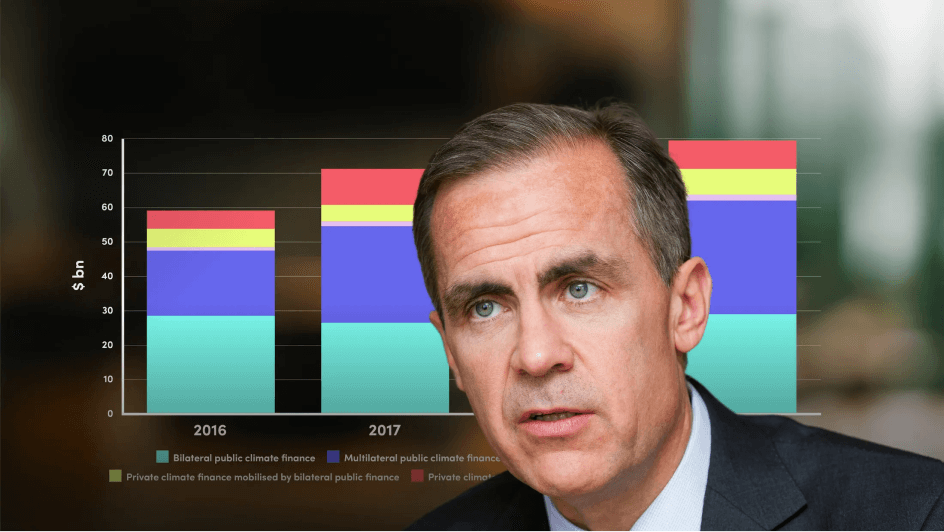

25 years: Sustainable Finance

In this video, Michelle Horsfield delves into the IFRS’ International Sustainability Standards Board (ISSB) and its significance in the global financial landscape. Michelle starts by explaining the evolution of accounting standards from the 19th century to the standardisation efforts of the International Financial Reporting Standards (IFRS) Foundation. She then delves into the ISSB and covers the key components of the standards S1 (General sustainability requirements) and S2 (climate-specific requirements).

In this video, Michelle Horsfield delves into the IFRS’ International Sustainability Standards Board (ISSB) and its significance in the global financial landscape. Michelle starts by explaining the evolution of accounting standards from the 19th century to the standardisation efforts of the International Financial Reporting Standards (IFRS) Foundation. She then delves into the ISSB and covers the key components of the standards S1 (General sustainability requirements) and S2 (climate-specific requirements).

Introduction to IFRS S1 and S2

14 mins 9 secs

Key learning objectives:

Understand the historical context and evolution of accounting standards leading to the emergence of sustainability reporting

Understand the structure and key components of ISSB

Evaluate the implications of ISSB's standards on financial reporting and investment decisions

Outline the practical insights into implementing ISSB's sustainability standards within organisations

Overview:

Imagine a world where companies transparently disclose their sustainability performance alongside financial data. Such disclosure isn't just a trend; it's becoming essential for investors navigating a rapidly changing global economy. Delving into the intricacies of ISSB's standards, we question how companies can adapt, what resources are available, and why this shift towards transparency is imperative for sustainable investing. Join us to explore the intersection of finance and sustainability, where disclosure isn't just about compliance but about reshaping the future of investments and corporate accountability.

Michelle Horsfield

There are no available Videos from "Michelle Horsfield"