Micro Level Evaluation of Climate-related Credit Losses

Tony Hughes

Climate risk modeller

In this video collaboration between the MMF, Grant Thornton, Finance and Sustainability Unlocked, Tony Hughes, expert risk modeller and data scientist outlines the link impact of climate change on the financial system. In the second video in his two-part series, Tony outlines why financial costs have been muted so far, pointing to the predictability of climate impact, which leads to closer preparedness from firms and investors.

In this video collaboration between the MMF, Grant Thornton, Finance and Sustainability Unlocked, Tony Hughes, expert risk modeller and data scientist outlines the link impact of climate change on the financial system. In the second video in his two-part series, Tony outlines why financial costs have been muted so far, pointing to the predictability of climate impact, which leads to closer preparedness from firms and investors.

Micro Level Evaluation of Climate-related Credit Losses

9 mins 39 secs

Key learning objectives:

Outline the micro-level evidence for the impact of climate change on the financial system

Understand why financial costs relating to climate change have so far been muted

Describe the hedging strategies in relation to climate change

Outline the value of building early detection systems into strategy

Overview:

Climate change has, so far, had a limited impact on the financial system. At a micro level, using natural experiments, analysis shows that the relationships between climate risks and credit risks are mixed. In some instances where people have been impacted by a climate event, they have ended up better off in the long run, whereas in some cases they haven't. It is suspected that financial costs have been muted due to the predictability of climate impacts and if climate impact is predictable, then investors, borrowers, and lenders can all make informed decisions on the basis of those projections, and those outcomes are less likely to go off the rails as a result.

What is the micro-level evidence for climate change impacting the financial system?

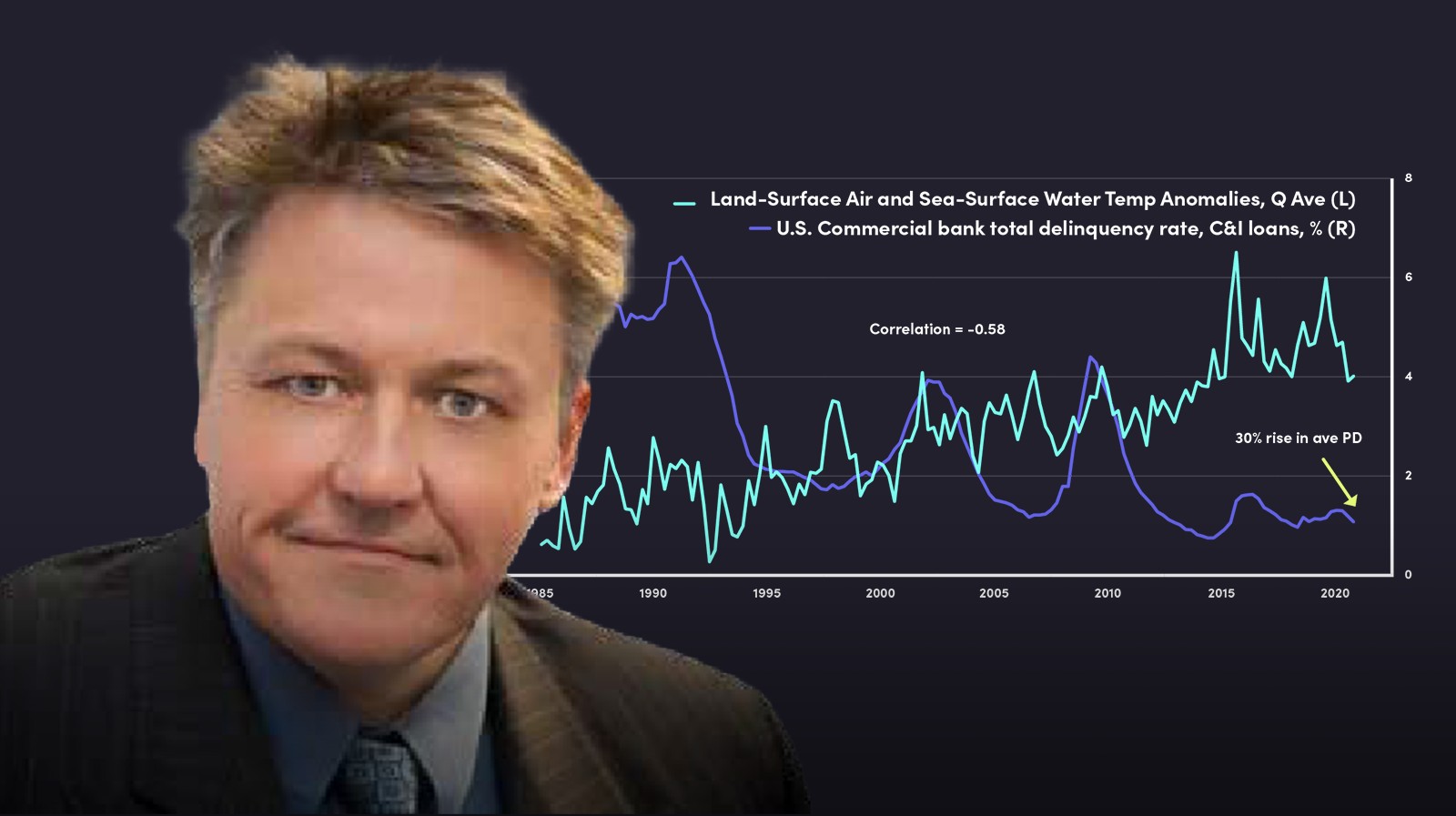

The first micro-level research into the link between climate and the financial system is referenced by Tony in Moody's Analytics paper, which looks at C&I loans, and this corroborates the analysis of the ECB's climate stress test. This empirical work uses a detailed analysis of perhaps the best database related to the physical risk that exists at the moment. The other paper that's a little bit counterintuitive is the report by Deryugina, Kawano, and Levitt. The interesting thing about Deryugina is that they compared Hurricane Katrina victims to a control group, and they then looked at tax return information and were able to track the individuals as they moved away from New Orleans following the event. They found that the people who were most affected by Hurricane Katrina had a worse short-term income outcome, but in terms of longer-term performance, the Hurricane Katrina victims actually performed better in the long term than the control group.

What theory does Tony Hughes suggest might be behind why financial costs in relation to climate change have been muted?

There is some predictability around climate impacts. There are physical consequences that were predicted very accurately by the previous generation of scientists, and climate transitions are more predictable than in other industries. If climate impact is predictable, then investors, borrowers, and lenders can all make informed decisions on the basis of those projections, and those outcomes are less likely to go off the rails as a result.

What is an example of the predictability of climate change and how it can impact investor decision-making?

In 1981, James Hansen, the leader of NASA's climate change research project made forecasts that have been stunningly accurate over the subsequent 40 years. Investors and lenders who are making decisions on the basis of the best available climate-related physical forecasts would've had a very accurate set of forecasts in their back pocket, and therefore good outcomes.

How do ‘hedging strategies’ explain why financial costs have been muted?

One theory behind why financial costs have been muted is the use of ‘hedging strategies'. The key belief behind the theory is that climate financial risks tend to migrate. Economic activities in the areas that are more at risk from climate change will tend to move to places that are less impacted by climate risk. There will of course still be some losers from climate change, but the survivors will increase in value and do better than the baseline. As a result of this, it may be possible for investors and lenders to hedge their strategies and move their investments around and as a result lessen the overall impact of climate change on the financial outcome.

Why will better detection systems be vital to ensuring the stability of the financial system?

Tony highlights the importance of early detection mechanisms for protecting the financial system. Although the risk has been muted in the past, if this starts to change, and if risk starts to build, then it's important that there are systems in place that allow early detection of those changes in risk. Building these early detection systems will rely on very detailed data and analytical techniques. The current stress tests overemphasise qualitative aspects and these provide low-quality sources of information that cannot be invalidated or built upon.

Tony Hughes

There are no available Videos from "Tony Hughes"