ESG Investment Data

David Wynn

15 years: Sustainability

ESG investing and sustainable investing are umbrella terms for investments that seek positive returns and long-term positive impacts on the environment, society, and the performance of the business. In this video, David talks about the difference between ESG and other forms of investing. He further introduces us to the six principles of the UN’s Principles for Responsible Investment and finishes by talking about the ESG metrics that provide an investor with insight into a company’s past impacts, current management process, and potential future resilience.

ESG investing and sustainable investing are umbrella terms for investments that seek positive returns and long-term positive impacts on the environment, society, and the performance of the business. In this video, David talks about the difference between ESG and other forms of investing. He further introduces us to the six principles of the UN’s Principles for Responsible Investment and finishes by talking about the ESG metrics that provide an investor with insight into a company’s past impacts, current management process, and potential future resilience.

ESG Investment Data

11 mins 58 secs

Key learning objectives:

What is the difference between ESG investing and other forms of investing?

The shift in the global investment landscape around ESG and sustainability criteria

The difference in ESG reporting amongst public and private investors

What are the key ESG metrics investors are interested in?

How are investors using and reporting ESG data?

Overview:

ESG investing and sustainable investing are umbrella terms for investments that seek positive returns and long-term positive impacts on the environment, society and the performance of the business. Looking at these ESG issues means that investors are likely to consider the long-term resilience of a business to adverse issues such as climate change, making ESG investing something crucially important for companies to pay attention to in today’s business landscape. Specific environmental, social and governance metrics are increasingly being gathered from portfolio companies to inform the business decisions of investors.

How has the investment landscape changed in relation to ESG?

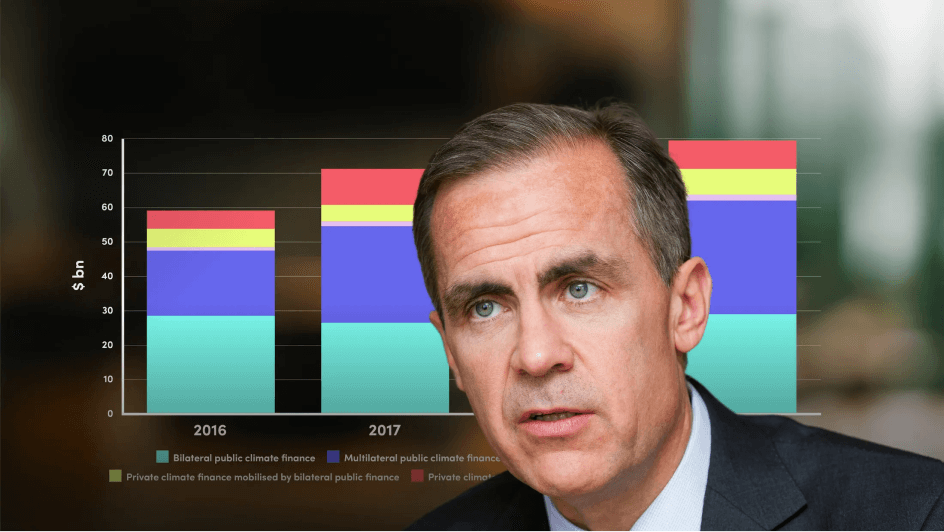

As companies have faced greater operational complexity on a global scale, investors have begun to re-evaluate traditional investment approaches. The transition of both public and private investors to becoming stewards of sustainability has been a result of multiple recent global factors.

What do different ‘sustainable’ investment terms mean?

- ESG investing takes into account how a company’s policies and practices impact profits and future returns.

- SRI (Socially Responsible Investing) is more closely focused on whether an investment is in line with the investor’s individual values.

- Impact Investing is made with the intention of generating positive, measurable social and environmental impact alongside a financial return. With impact investing, investors are looking to put money into market segments or businesses dedicated to solving pressing global issues such as renewable energy and healthcare access.

How is ESG reporting different for public and private investors?

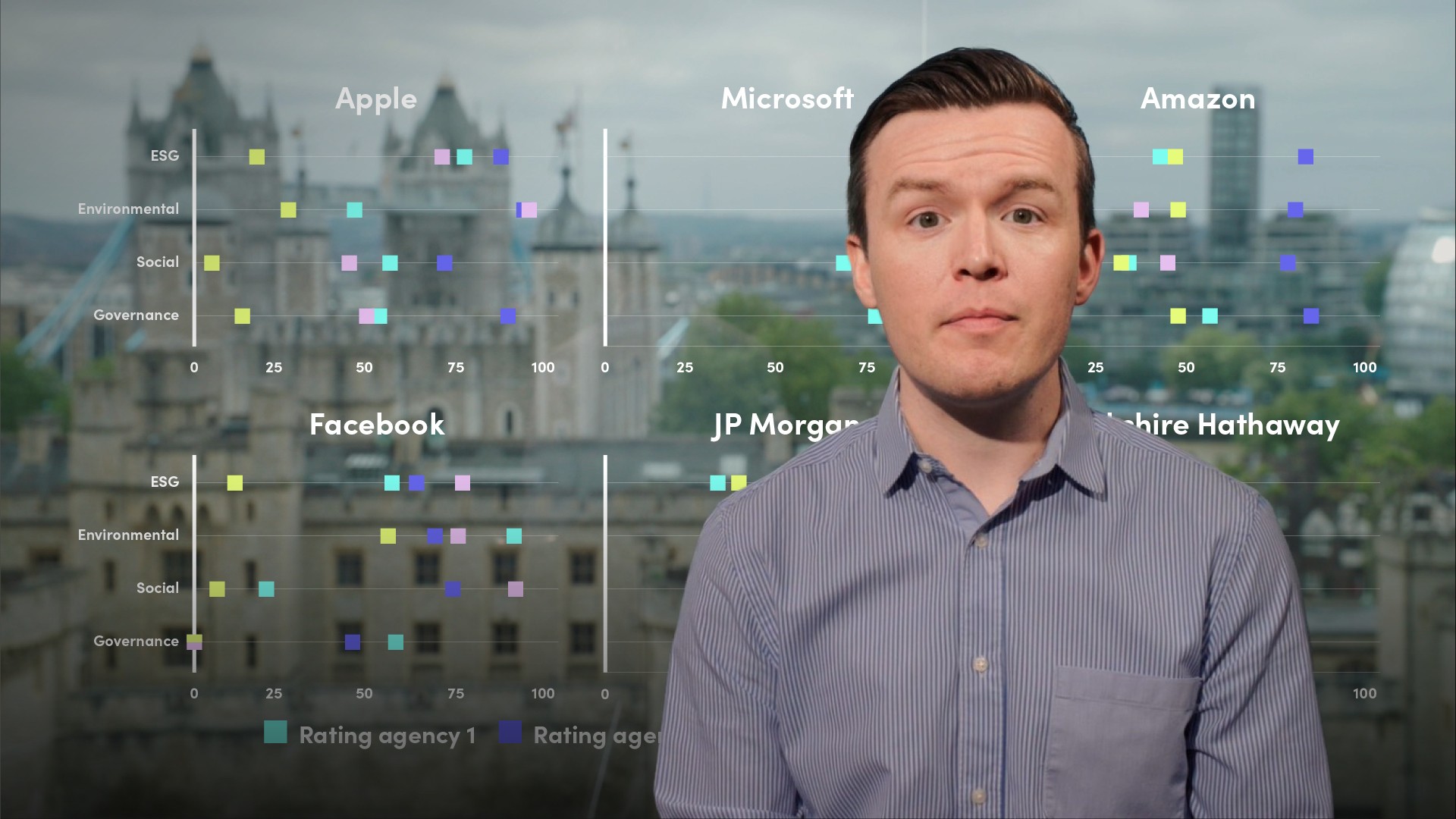

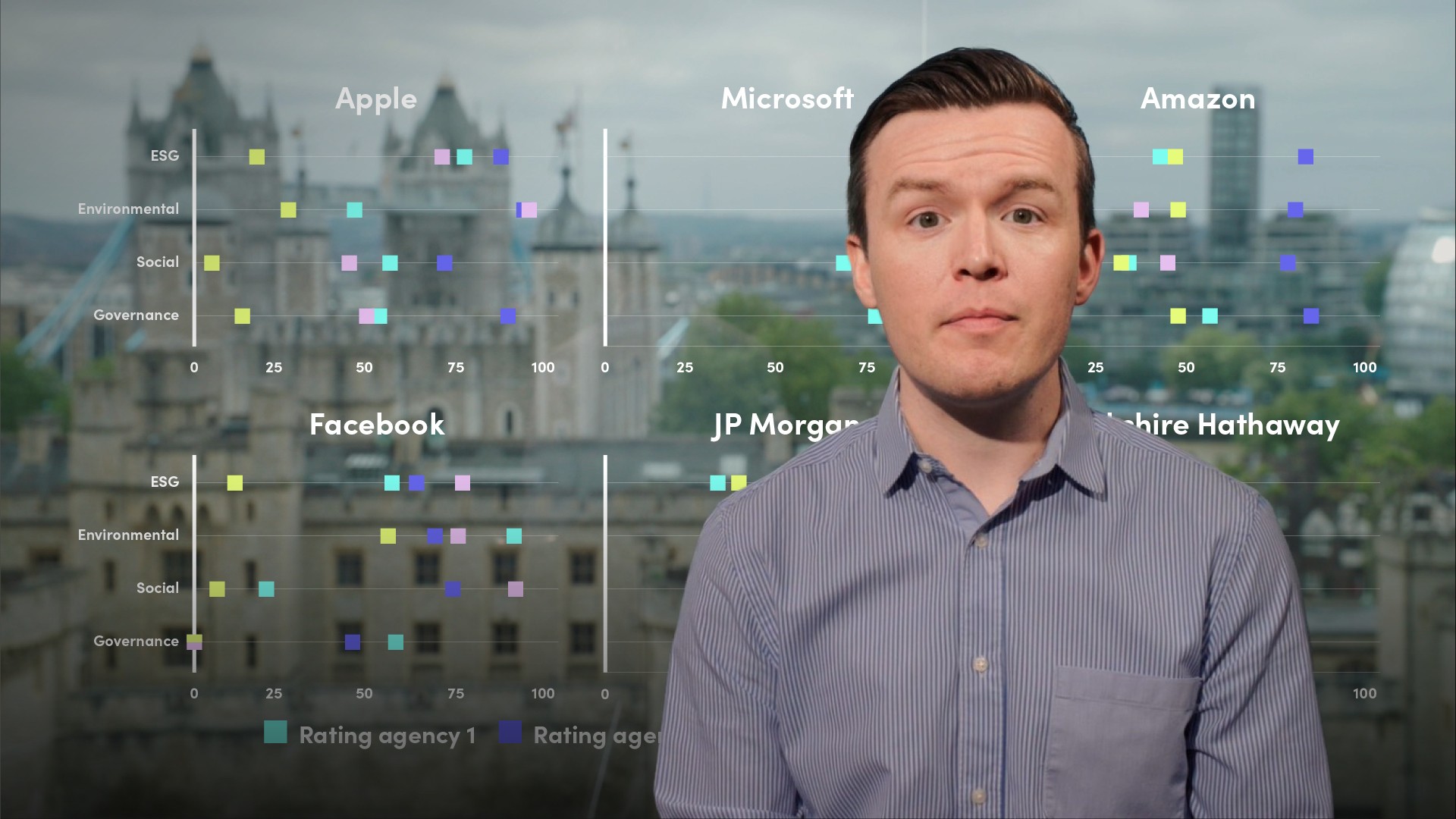

- Publicly listed companies are expected to openly report their ESG performance against reputable frameworks and have this public data assessed and scored. Organizations like Bloomberg, S&P Dow Jones Indices or MSCI will carry out this type of assessment, scoring a company on their ESG performance. Scores are likely to vary among rankers and raters, which may employ different metrics and weighting schemes.

- Private investors will typically define their own ESG metrics that they are interested in gathering from their portfolio companies. Private investors are more likely to have closer relationships with their portfolio companies and as a result will be in a strong position to support companies with their ESG goals and strategies, making the whole thing a collaborative process.

What ESG metrics are typically reported to and by investors?

Companies may produce specific reports, tables or data annexes designed for investors to be able to easily digest ESG related information, which as we touched upon earlier will fall into one of the three following categories:

- Environmental metrics that an investor may look for from a company consider how that company performs as a steward of nature and the natural world.

- Social metrics examine how a company manages its relationship with employees, customers, its own suppliers and wider communities.

- Governance metrics look at a company’s leadership and how the organization is managed.

Together, these ESG metrics provide an investor with insight into a company’s past impacts, current management process and potential future resilience. Investors will often score each of these data points to be able to compare performance over time and to benchmark companies against their peers.

David Wynn

There are no available Videos from "David Wynn"